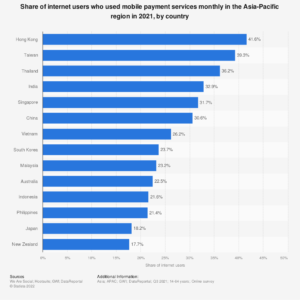

While North America and Europe debate the inevitable cashless future, the Asia-Pacific (APAC) region has already experienced a remarkable shift in the adoption and usage of alternative payment methods (APMs) in recent years.

The surge in digital wallets, eCommerce, and emerging technologies has propelled the region to the forefront of the global cashless revolution.

This article provides an overview of the current APAC payments landscape, highlights popular payment methods across various countries, and discusses the impact of APMs on the overall shopping experience.

APAC Payments Overview: Low Penetration of Traditional Banking

In China, consumers pay with either WeChat or Alipay – two of the country’s favourite payment platforms that handle 94% of China’s US$5 trillion mobile wallet transactions yearly. Within India, mobile transactions have doubled after the government made 500 and 1000 rupees illegal tender.

In Korea, the rise of TPay, a system that clears US$435 a month for authorized payments using mobile carrier data, has helped the country become almost completely cashless.

Without any doubt, the APAC region is leading the adoption of these new alternative payment systems through the use of emerging technologies and fuelled by changing consumer shopping behaviors – with 95% of Asia-Pacific consumers shopping online regularly.

This trend also shows its presence in the West, with Caesars Entertainment, a Las Vegas hotel and casino experience, integrating WeChat as a payment program, allowing visiting Chinese tourists to use their WeChat Pay within their facilities.

Another factor fueling the accelerated shift wards digital payments was the COVID-19 pandemic, as consumers and businesses alike have sought contactless and efficient payment solutions. In China alone, the eCommerce market increased by 17% and continued to grow during the pandemic, with Gen-Z shoppers making up 56% of new internet shopping users.

The drive to adopt AMPS in the APAC region has led to the following emerging key payment trends: offering unmatched payment processing, using private data to personalize customer experiences, building long-term payment strategies, and rapidly moving away from cash.

But while these developments may — and to some extent will — influence how we pay globally, differences in payment services are inevitable and necessary. Ultimately, payments are like languages. And what’s working in China, South Korea, and other Asian-Pacific countries won’t necessarily work elsewhere.

Popular Payment Methods in APAC

The diverse and vast consumer base in APAC countries has led to the emergence of various popular payment methods catering to the unique needs of each market:

China – AliPay and WeChat

In China, AliPay, operated by Ant Group, is the most utilized digital payment app. Meanwhile, Southeast Asia is witnessing a surge in digital payment adoption, with emerging startups like Indonesia’s Gojek and Singapore’s Sea platform gaining traction.

A Rakuten Insight survey in October 2022 revealed that GoPay by Gojek was the preferred e-payment service in Indonesia, used by 78% of respondents. Additionally, PayPal dominated the Southeast Asian market, with a significant presence in Indonesia, Malaysia, the Philippines, Singapore, and Vietnam.

Get up-to-date market metrics and insights to help you enter the Chinese eCommerce market and take on established regional players.

Globally, countries are following suit and embracing their own versions of digital payment methods:

India – UPI (Unified Payment Interface)

UPI is among India’s leading alternative payment platforms, accounting for 10% of the country’s retail transactions. This real-time payment system enables users to conduct P2P or P2M transactions via their mobile devices.

Furthermore, UPI is integrated with other countries’ systems, such as Singapore’s PayNow, Bhutan’s BHIM app, and Nepal’s NIPL.

Get the insights and guidance needed for entering and achieving traction in the Indian eCommerce market.

Australia – POLi

Australia’s developed economy, minimal restrictions on imports, and abundant natural resources set the stage for cashless transactions to become the norm by 2025.

POLi is an alternative payment method that allows businesses to receive funds directly into their bank accounts.

Find out how to enter the Australian eCommerce market here.

Thailand – TrueMoney

In Thailand, TrueMoney is the go-to e-wallet, boasting over 15 million users and attractive low acceptance fees. A Visa study revealed that 9 out of 10 Thai consumers prefer cashless payments, driven by COVID-19 concerns and the growing number of businesses offering cashless options.

TrueMoney provides a secure and convenient cashless experience and empowers users to pay bills, transfer money, book attractions, and more.

Bangladesh – bKash

Although Bangladesh was slow to adopt digital payments, the COVID outbreak accelerated this shift. Despite challenges like financial exclusion and trust issues, the country’s central bank anticipates continued growth in digital payments, including bKash.

As a mobile financial service, bKash allows users to deposit money into their mobile accounts and access various services such as bill payments and money transfers.

Pakistan – Easypaisa

EasyPaisa, launched in 2009, is a mobile-based payment service in Pakistan that caters to Telenor Pakistan mobile phone users. Ranking as the world’s third-largest mobile money deployment – enabling users to pay bills, transfer funds, and access government benefits. This versatile service streamlines transactions for users across Pakistan, aligning with the growing trend of alternative payment methods.

Moving forward, understanding how APAC countries tackle APM adoption will be crucial for businesses looking to offer seamless payment experiences in this diverse region.

How APAC countries face the APM adoption

The use of APMs is strongest in the APAC regions – reflecting the region’s diverse population’s unique preferences and needs. Consumers overwhelmingly prefer eWallets, bank transfers, and cash-on-delivery options over traditional payment methods.

Let’s have a look at some of the reasons behind this.

Modernizing Legacy Infrastructure and ISO 20022

Great system changes have their fair share of complications. With the increasingly widespread adoption of smartphones and consumers’ preferences to use eWallets, traditional legacy banking systems are lagging – they simply were never designed to handle the pressures of 24/7/365 real-time transactions.

The need to update the system is evident. Banks in the APAC region are scrambling to move towards the new ISO 20022 standard, which will involve processing larger data volumes faster for real-time payments, daily liquidity management, fraud detection, and compliance checks.

However, user adoption is still a challenge, with a study showing that implementation of user-focused technology will ultimately lead to wider acceptance of a completely cashless society.

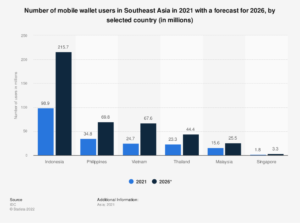

Smartphones and eWallets are influencing APAC’s payment processing landscape

China accounts for the highest usage of smartphones in the world, with over 865 million users. India is trailing not too far behind, with 606 million users. Additionally, the country’s growing adoption rate of the Internet and digitizing market sector in India are influencing citizens’ APM usage.

Both of these countries have adopted eWallets offering payment convenience and security. As a result, many banks and payment processors are now re-evaluating their business strategies, especially in improving their existing infrastructure, as mentioned before, to keep up with their consumer base and retain market share.

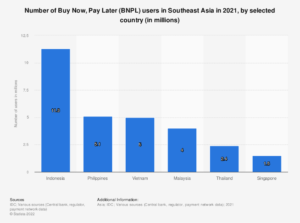

Buy Now, Pay Later (BNPL) in APAC

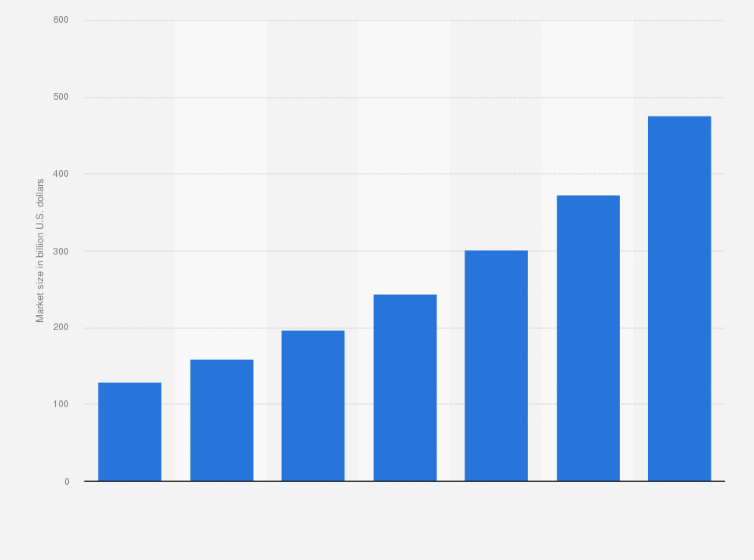

The emergence of BNPL solutions has further transformed the payments landscape in the region. According to Statista data, these flexible financing options have gained traction in APAC, providing consumers with convenient and accessible alternatives to traditional credit products.

The “Buy now, pay later” trend has experienced a significant boom among the Gen Z and Millennial workforce; however, this growth may wane as economic conditions decelerate.

Additionally, it is anticipated that APAC countries will follow in the UK government’s footsteps in implementing stricter regulations on BNPL, which could further impact its future prospects.

Alternative Payment Methods in APAC

This changing landscape demands an in-depth understanding of consumer preferences and the market’s direction for businesses seeking a frictionless payment experience in the Asia-Pacific region.

There’s a notable appetite for innovation in APAC, with developing markets such as Malaysia, India, Thailand, and Indonesia demonstrating a higher adoption rate of APMs. These consumers, who consider themselves tech-savvy, are keen to find the right solutions for their needs.

Although cards and card-powered wallets remain popular in developed APAC countries like Japan, Taiwan, Singapore, and South Korea, the preference for eWallets and bank transfers has increased significantly across the region.

Some emerging economies are bypassing the card stage altogether and seeking out new ways to pay online.

The multitude of APMs used across APAC, such as Paytm in India, OVO Wallet in Indonesia, True Money in Thailand, and Maybank2u in Malaysia, presents both opportunities and challenges for businesses.

As their popularity surges globally, businesses must keep their finger on the pulse, adapting to ever-changing markets and consumer preferences.

APMs and the Seamless Shopping Experience

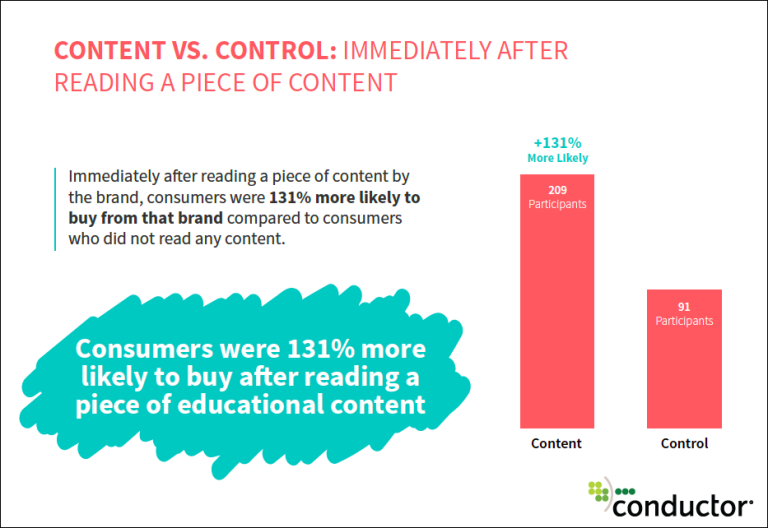

APMs are more than just diverse payment options; they are designed to integrate seamlessly into the customer experience, catering to various preferences. This tailored approach enhances customer satisfaction and encourages repeat transactions while reducing friction in the checkout process and resulting in higher conversion rates for online retailers.

Moreover, APMs have the potential to revolutionize the shopping experience. For example, Singapore’s PayNow, a peer-to-peer funds transfer service initially available to retail customers, has expanded its scope to include businesses and merchants.

By enabling instant payments through a simple QR code scan or mobile number input, PayNow eliminates the need for entering lengthy bank account details, making transactions faster and more convenient. This ease of use promotes a smoother shopping experience and fosters cashless transactions nationwide.

By incorporating APMs like PayNow into their payment offerings, businesses can create a seamless shopping experience that meets the needs and preferences of their customers, ultimately boosting satisfaction and driving repeat business.

Conclusion

The rise of alternative payment methods in the APAC region has revolutionized the eCommerce landscape, providing consumers with many options that cater to their unique preferences and requirements.

As the region continues to lead the global cashless revolution, businesses must adapt and embrace these emerging technologies to remain competitive and meet the evolving needs of their customers.

In the face of an increasingly digital world, APAC’s rapid adoption of APMs serves as a testament to the transformative power of technology and its potential for reshaping global commerce. And as this region continues to innovate and push boundaries, the rest of the world will follow suit, leading to a more connected, convenient, and secure future for all.