Cross-border payments are complicated and confusing – but they don’t have to be. Here’s everything you need to know about how value is moved between countries.

It may sound almost insultingly simple, but we should start with defining our terms.

Cross-border payments are those where both parties to the transaction – the payee and the recipient – are in separate countries.

In practice, however, things get a lot more complicated, largely because individual countries’ banking systems and currencies are usually closed systems.

In this article, we’re going to fill you in with everything you need to know to gain a working knowledge of how individuals and companies send money between countries.

It’s knowledge worth having, too. By one estimate, the total annual value of cross-border payments is expected to reach $250 trillion by 2027 – an increase of 150% from 2017’s figure.

How do cross-border payments work?

There are three primary models for cross-border payments, so we’ll begin by breaking them down.

In these examples, we’ll leave the retail user out, and focus in on two example institutions making a wholesale payment: Bank A, in the country where our specimen payment originates, and Bank B, in its destination country.

The central idea to begin with is a ‘payment message’ – an electronic signal issued by a banking customer instructing two banks to instigate a transaction.

- Dual accounts

This is the simplest version, where Banks A and B have a direct relationship.

In this model, a payment message instructs Bank A to debit an account a certain amount, and Bank B to credit an account the same amount.

Because the infrastructure already exists between them, they can conduct the transaction in much the same way as a domestic payment.

This approach is usually limited to large international banks.

- Correspondent banking

If Bank A and Bank B do not have a direct relationship, they’ll require an intermediary institution to act as a middleman.

This is a ‘correspondent bank’ – one that both Bank A and Bank B have accounts with, and that will require a payment message for each individual payment, in this case two. However, there can be many correspondent banks in the process.

- Correspondent banking networks

For conversions between currencies with lower volumes of payments, there could be multiple correspondent banks in the process, with each link in the chain adding time and cost to the transaction.

The actual mechanics aren’t different to correspondent banking – there are just more intermediaries between Bank A and Bank B.

Why are cross-border payments complex?

So, we’ve established that cross-border payments aren’t as simple as making a domestic payment.

But why are they so much more complex?

- High costs

For conversions between currencies with lower volumes of payments, there could be multiple correspondent banks in the process. Each link in the chain will add to the cost to the transaction in the form of processing and FX conversion fees, and there may be regulatory penalties added.

- Longer time to complete

More nodes in a network inevitably means more processing time at each stage of the payment’s journey. It may sound strange in the era of digital banking, but time zones and whether a payment is made in a bank’s opening hours are crucial factors here.

- Fragmented data formats

There has been a lot of progress in recent years (see below), but there is still no standardised international format for payment messages in universal usage. This means additional time and resources must be spent ‘translating’ messages between formats – resulting in costs passed on to the user.

- Legacy data platforms

Overlapping with fragmented data formats is the issue of legacy data platforms. Much of the core tech infrastructure in banking can be decades old and, while it may have been cutting-edge at the time, has been left behind by the pace of innovation elsewhere. For example, many banks still use COBOL – a programming language first introduced in 1959.

- Security issues

A payment is only as good as the security its provider can offer – otherwise, nobody would want to use their service. Many institutions are in a constant arms race with malicious actors that requires constant innovation and vigilance, with machine learning recently coming online to help stop suspicious transactions.

What is changing in the regulatory payments landscape to support cross-border payments?

With a list of issues that long, it’s not surprising there have been serious international efforts to simplify and rationalise cross-border payments.

The two most significant are:

- The G20 effort

In 2020, the G20 organisation of the most economically significant countries in the world tasked its Financial Stability Board (FSB) with working with its Committee on Payments and Market Infrastructures (CPMI) and other international standards bodies with creating a roadmap for improving cross-border payments.

This roadmap, published in October 2020, set out a plan for collaboration between these bodies and the private sector on enhancing cross-border payments. The full document runs to 36 pages and covers 19 building blocks, encompassing everything from reciprocal liquidity arrangements to central bank digital currencies (CBDCs) to further data harmonisation – which brings us to:

A long time in development, this is the new international standard data format for electronic messages between financial institutions. It offers its users the opportunity to embed more data in payments messages, requires less manual intervention, has been designed to be flexibility integrated into systems new and old, and supports automated processing. Almost 200 systemically significant institutions have either committed to adopting it or are in the process of adopting it.

Given the scale and complexity of the global financial system, transitioning to this new standard is a truly enormous undertaking, and different countries, banks and other players are at different stages of migration.

In the UK, the Bank of England began the move to ISO 20022 for its CHAPS platform for high-value transactions in the summer of 2022.

- The Single Euro Payments Area (SEPA) scheme

The Single Euro Payments Area (SEPA) is a regulatory standard that unifies payment processing amongst euro-using nations, in order to make cross-border cashless payments easier. SEPA enables people to do cross-border transactions in euros within the 36 SEPA member countries, with the same ease as domestic transactions.

Capabilities and market developments for cross-border payments

We’ve gone pretty quickly from relatively simple descriptions of transactions between international banks to a brief overview of one of the most significant shifts ever to the back-office operations of the global financial system.

It’s worth taking a moment to ask – what is all this in aid of?

In short, cross-border payments – international payments – unlock the possibilities of international growth.

How do they do this?

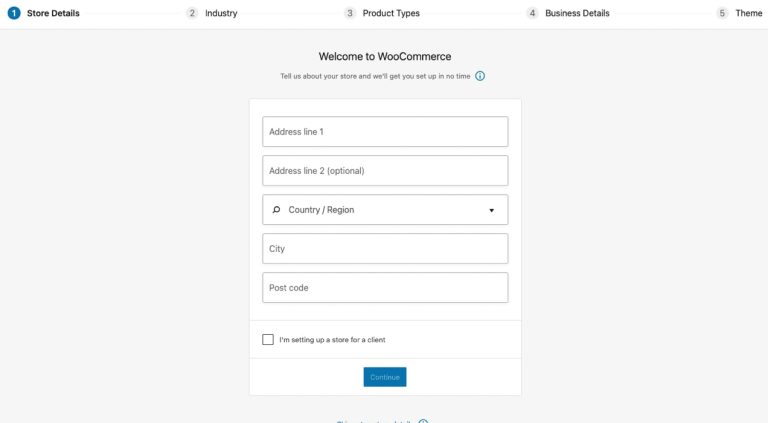

Localizing the shopping experience

Like a duck paddling furiously under the water, the consumer shouldn’t see the payments infrastructure that lies behind their shopping choices.

Cross-border payments enable the removal of the friction points that bring this architecture above the surface and empower service providers to offer more services in the consumer’s local language, currency and payment method.

This carries obvious benefits to the user experience, but there’s a colder commercial imperative in play as well.

Greater visibility on FX rates

As anybody who’s ever been on holiday knows, these can be a pernicious hidden cost in a number of surprising ways. Scale this issue up to a global business, and the problem is compounded.

However, APIs (Application Programming Interfaces) offer a way out of this bind.

These are plug-and-play solutions that enable communication between digital infrastructure and interfaces – for example, you use one if you use the same account on the same app on both an iPad and iPhone.

In this context, they allow corporate treasury departments to access real-time FX data direct from the provider, which means they can more effectively manage their currency exposure, better manage risks between their global accounts wherever they are, and speed up settlement of a transaction thanks to gaining visibility on FX rates earlier in the process.

Working with a local acquirer

You can’t be everywhere at once, and you can’t conduct a transaction with everyone everywhere.

However, the developments in data standardisation we mentioned above are making it much easier for businesses in one country to work with a local acquirer – i.e. a bank that processes credit and debit card payments in the other country on the business’s behalf.

Alongside the intelligent payment routing that new, enriched data standards are making possible, this will sharply reduce the number of transactions that will fail.

Real-time payments

In the developed world, many of us take real-time payments for granted – but they are far from routine across much of the global economy, despite expectations having been significantly raised by the near-instant payments most users enjoy with their retail banking provider.

The benefits of eliminating a sometimes lengthy settlement period are clear for any business, but real-time payments also offer greater visibility across the entire payment chain and should speed up sensitive processes around sanctions screening or other friction points in international trade.

From innovative blockchain solutions to answers from legacy providers like SWIFT’s GPI (Global Payments Innovation) platform, there are a number of streams coming online that are making instant cross-border payments a reality.

Conclusion

Overall, in a globalized world, cross-border payments are a fact of life.

They have long been considered overly complex, expensive and time-consuming.

However, a number of initiatives from regulators, international bodies and the private sector are now coming online that promise to radically enhance the experience for all participants in the value chain – and in the process unlock substantial value as part of the next generation of globalization.

Looking to discover more about how to enhance your shoppers’ experience by localizing the buying experience to their preferences? Check out this webinar, to discover the type of eCommerce capabilities that can help you prepare your expansion into local markets.