(This article is written for existing store owners considering growing via acquisition. However, most of the concepts apply to first time store owners as well).

Entrepreneurs suffer badly from shiny object syndrome. It’s incredibly hard to pass up opportunities despite the fact we have a list a mile long of things we’re still working on!

This sickness is possibly at it’s worst when you find the “perfect” business listing, one that would dovetail into your current operation wonderfully.

Tread carefully, this is dangerous ground.

Consider your domain registrar. If it contains a graveyard of unused domains along the likes of “guinnapigyoga.com”, you know how your brain can sometimes misjudge opportunity. Except instead of being out $12.95 for an ill-advised domain you’ll be out thousands or millions of dollars on a poorly-picked business acquisition.

Here’s 8 questions to ask yourself before you get too far down the rabbit hole.

Do You Understand Why They’re Selling?

I can answer this one for you: no. No, you don’t.

Sure, they may say they’re selling because they want to focus on other projects or spend more time with their kids. And that may be true.

But the truth is no one in the world has better visibility into the best time to sell than the current owner. And if their years of experience and industry expertise lead them to believe that the future doesn’t look quite as rosy you can bet they aren’t going to put that front and center on their marketing prospectus.

Buyer beware. You’ll need to really dive in to make sure you’re buying something with long-term potential. Speaking of due diligence….

Do You Have the Skills to Do Due Diligence Well?

Know your way around Google Analytics reasonably well? Can you re-create an income statement from half a dozen credit card and bank statements? Can you perform a SEO backlink audit?

I hope so, because all of these are things I’d absolutely want to do before writing a big check for any business. If not done correctly you could unknowingly be buying a business with long-term traffic issues, organic traffic that will disappear at the next Google update or cooked books that inflate earnings.

There are some great services like Centurica that can help mitigate risk but nothing beats rolling up your sleeves and diving in yourself.

Do You Understand Their Reputation?

Recently, one of the ECF Capital companies was considering buying a business. Everything seemed perfect: the company had been around for years, had a well-known product that their existing customers would love and the prices seemed reasonable.

There had been a few PR issues in the past but those were largely behind the brand and associated with the past owner. Or so the potential buyers thought….

After talking to a number of customers in the space it became apparent the brand’s image had been so badly stained by the owner it was unlikely even new ownership would be able to shake the reputation.

Most acquisitions won’t have quite this serious of a reputation problem. But all companies have built some kind of reputation in their space. It’s important you understand what kind.

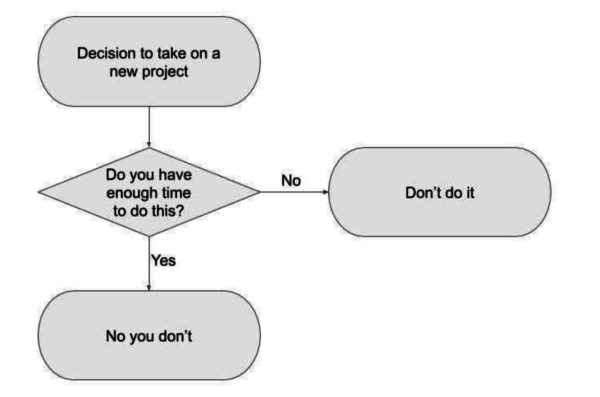

Do You Have the Bandwidth?

Image credit to @khemaridh on Twitter.

Most acquisitions, even small ones, will take 2-3 months minimum. Large sales/purchases can take up to 6 months or more and I’ve heard of some dragging on for a full year.

Are you ready to have you next quarter or two largely taken over?

For the right business and fit, buying a business can be a great strategic move. Just make sure you’re coming into it with eyes wide open regarding how much time it will take. The answer in all cases: a ton.

Will You Starve Your Core Business of Financing?

One of the biggest challenges for growing eCommerce companies is financing. Due to the negative cash cycle of inventory-based business (needing to pay for goods before you can sell them), finding ample financing to support a quickly growing eCommerce company can be tough.

If you’re financing the potential acquisition you’ll be adding debt to your company. The more debt you have, the less likely borrowers will be to future lending for critical inventory-purchasing needs.

Yes, the additional EBITDA/earnings from the new company will help offset this extra debt load. But you’d be wise to chat with your banker/lender to understand how the additional debt will impact you ability to borrow going forward.

Do You Have Leverage?

The best deals come when you’re negotiating from a position of strength. Generally leverage comes in two types: macros and micro.

Macro leverage takes into consideration the economic and M&A environment. As I write this near the beginning of 2022, the M&A market for eCommerce businesses is red hot. Multiples have gone up meaningfully in the last 18 months, funds are flowing freely and there are far more buyers than sellers.

From a macro perspective that means you have much, much less leverage. Your chances of getting a sweetheart deal, negotiating buyer-friendly terms or scooping up an 11/10 company without having to fight the competition are low.

Micro leverage is when the seller has certain timeframes, limiting beliefs or important deal terms that you can use to your advantage during negotiating. Or perhaps there are significant cost savings that allow you to spend more on the business than others.

Financially, the best deals happen when you have some degree of leverage or, at a minimum, aren’t fighting against the leverage others have over you. Just make sure you understand which side of the fulcrum you’re on.

Note: Leverage has a negative connotation but it doesn’t necessarily mean you’re acting unethically. If someone has to sell a business in the next 2 weeks you have a significant amount of leverage when making an offer that closes during that time frame. As long as you’re keeping your word and not being predatory leverage can be something that is ethically employed for great deals.

Have You Fully Tapped the Opportunity in Your Current Business?

There are massive transaction costs when you buy a business. What if instead you took those hundreds (or thousands) of hours and worked on your existing business instead?

If you’re business is a well-oiled machine and you’ve taken advantage of the easy opportunities this won’t apply. But I’ll be there’s a lot left on your “to-do” list that can immediate add value to your current business.

Are the Product Lines Complimentary?

Are you confident that the new product line being acquired will be a good cross-sell fit for your existing customers?

Hands-down one of the largest benefits of buying a new business is the new customer bases you can now cross-market to. And being able to leverage your existing store’s customer base to sell more of the newly acquired products.

If the product lines aren’t similar you’re giving up one of the biggest perks of buying.

Getting Advice from Deal Experts

Inside of eCommerceFuel, our Community for 7- and 8-figure store owners, our members regularly give and get feedback on acquisitions. It’s full of eCommerce veterans, ex-Investment Bankers and people who have bought and sold dozens of eCommerce stores across their online careers.

Our ‘Buying & Selling Stores’ category alone has hundreds of past discussion you can learn from and our 1,000+ members are always eager to weigh-in with their experience if you’re considering a major acquisition.

There’s no other place on the planet where you can get fast, qualified advice from a community with hundreds of deals under their belts.

Sound interesting? Apply for membership and join us here.