It’s always important to understand your customers’ perspective, especially at key conversion points like checkout. A critical part of an effective checkout experience is providing a safe, easy method for customers to check out with the payment method of their choosing.

Deciding to accept cryptocurrency on WooCommerce is a great step that will help you meet this need and appeal to a wider audience. And depending on which cryptocurrency payment solution you choose, your processes as a merchant might not look much different than traditional payment methods. However, customers paying with crypto will have a different experience, and learning what that looks like can help you become a better store manager.

In this article, we’ll help you understand a payment transaction from your customers’ point of view. With this knowledge, you’ll be well equipped to spot opportunities to increase your conversion rate, offer direct support, and educate your customers and prospects.

Crypto vocab check

You can dig into each of these terms a bit further here. But here’s a summary of the most important terms:

Public key: Essentially, the information someone needs in order to send you cryptocurrency.

Public address: A hashed (basically, shorter) version of a public key. This is what you might share with someone who wants to send you money. Think of it as a Venmo username or PayPal.me link. (e.g., 0x12B0aD31f483Cdf4741de8f5679A472E5fe3345G)

Private key: Allows a user to access funds sent to a public key. This should never be shared with another party.

Web3: Defined by AP Stylebook, Web3 is a catchall term for the prospect of a new stage of the internet driven by the cryptocurrency-related technology, blockchain.

Web3 wallet (crypto wallet): Stores public and private keys for blockchain transactions.

Seed phrase: A list of 12-24 randomly-generated words that grant access to a Wweb3 wallet. This can be used to recover access to a cryptocurrency wallet. This should never be shared with another party.

Non-custodial wallet: Users own their private keys and possess full access to their Wweb3 wallet. (e.g., Metamask, Trust Wallet.)

Custodial wallet: Private keys are possessed by third-party companies. (e.g., Coinbase, OpenNode.)

Peer-to-peer payments

You might be thinking, “Isn’t a major point of cryptocurrencies the fact that they’re peer-to-peer and don’t rely on third parties?”

Yes, it’s entirely possible for you to receive funds from a customer without needing to use any third-party service or tool.

However, this simply isn’t realistic for the average consumer. They’re not going to run their own node, generate transactions from a terminal command line, and memorize their private keys. Likewise, most merchants are happy to pay a small transaction fee in order to give customers a low-friction experience, while saving themselves a lot of time and energy reconciling payments to orders.

So, this article focuses on typical ecommerce transactions using tools and services most likely to be adopted by beginner and intermediate-level users.

Overview of making a crypto payment

From a customer’s perspective, there are three steps:

- Get access to a funded crypto wallet.

- Connect their wallet.

- Complete the payment and receive a confirmation.

The specific experience depends on the payment processor and wallets involved. Let’s run through a couple of examples and talk about what’s happening at each step for your customer.

1. Get access to a funded crypto wallet

There are lots of options for folks who want a crypto wallet. Each option comes with its own features, benefits, and support for different cryptocurrencies, chains, and payment experiences.

‘Traditional’ digital wallet providers like PayPal and CashApp now support crypto payments. Industry-leading crypto exchanges like Coinbase, Crypto.com, and Binance offer their own apps, which also serve as payment wallets. Then there are crypto-native wallets like MetaMask, Rainbow, and many others. You should do your own research to determine the best option or options for you.

After choosing a wallet and getting it set up, the next step is to add some cryptocurrency to it so that you have an available balance to spend. This is usually a quick process because most wallets offer in-app purchase options.

So how does a customer know which cryptocurrency to add?

This is a good question! Often, it doesn’t actually matter, aside from fees that can add up if they have to exchange currencies. Some crypto payment processors will provide automatic exchange options so that customers can pay you in one currency and you receive it in another.

Where that’s not possible, most crypto wallets offer in-wallet exchange/swap functionality so that if a customer holds bitcoin (BTC) but wants to pay in ethereum (ETH), they can make that swap easily. Ideally you’ll load the wallet with whatever currency you want to pay in, but that’s not always possible in advance of deciding to make a purchase.

2. Connect their wallet to your site

There are two main ways that a customer can connect their wallet to your site: QR code or browser wallet connect. Crypto payment processors may offer one or both of these as options.

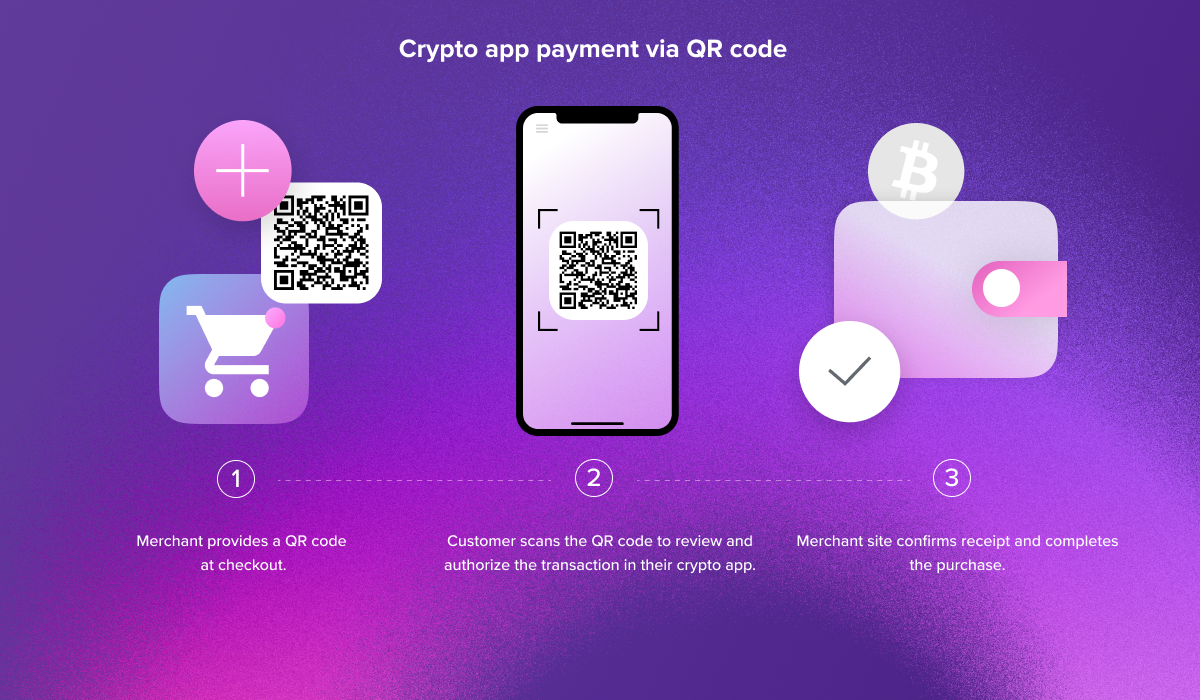

QR code

This route is best for customers who have their crypto wallet as an app on their phone. When someone chooses to pay with crypto, they’re presented with a QR code that they can scan with a utility in their crypto wallet app.

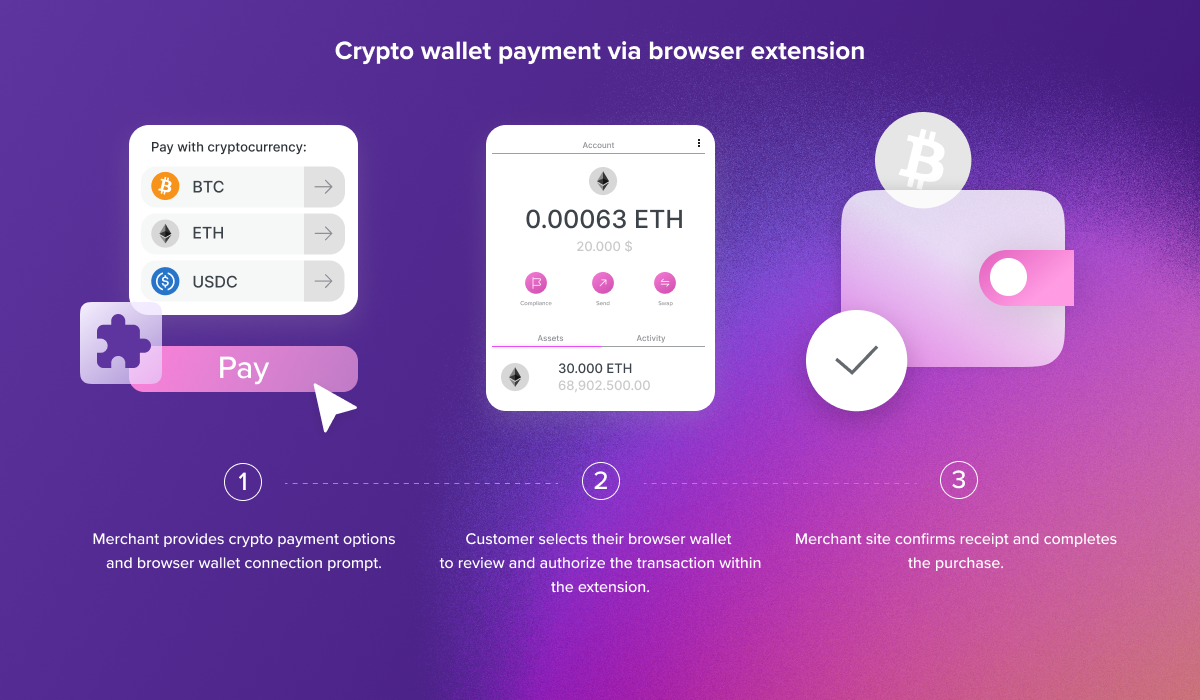

Browser wallet connect

This route is best for customers who access their crypto wallet via a web browser extension. When someone chooses this route, they’re prompted to connect their Web3 wallet by clicking a button, which invokes the browser wallet and asks for authorization to connect.

3. Complete the payment and receive a confirmation.

Whichever route the customer follows, the wallet will then provide prompts that guide them through making payment – either in the app or the browser.

Once payment is made, there can be a delay (usually only seconds) before payment is confirmed by the blockchain. At this point, you and your customer will both receive a confirmation. Where transactions are made directly on-chain, you may both also receive a blockchain transaction ID.

And that’s it!

What do crypto payments processes mean for merchants?

There’s a big difference between a customer who’s already familiar with crypto and is ready to complete a transaction and someone who’s never used crypto before. Getting set up with a crypto wallet, funding it, and understanding the process to complete a transaction are all barriers to entry.

At first, most crypto payments are likely to come from more experienced crypto users. Over time, this number is expected to grow significantly. So, if your followers and customers have indicated that they’re interested in crypto, it may be worthwhile to direct them to reputable sources so they can learn how to pay you in the way they prefer.

Benefits of crypto payment options to your customers

In the first article in this series, we explored reasons that accepting crypto makes sense for many merchants. But why would your customers want to pay in crypto?

- They hold crypto and want to spend it! Perhaps they were an early investor, they’re a great trader, or they get paid in crypto.

- It’s cheaper for them to spend crypto directly than to accept exchange and/or forex fees for traditional payments. This can be particularly true for international customers.

- They may not have access to other payment methods.

- They may prefer to keep certain transactions private or separate from their other financial activities.

- They feel it’s more convenient and secure.

- They value being able to transact without paying fees to traditional financial service providers (i.e., they’re ideologically-driven).

- There are no limits to daily payment amounts – this particularly applies to high-cost, luxury items that might exceed a user’s daily banking limits.

- They’re paying for a digitally-native asset like an NFT.

Customer considerations to bear in mind

As you can see, there are a lot of options when it comes to crypto payments from a customer experience. Here are some things that are worth bearing in mind when choosing and operating crypto payments:

- How easy is it for your customers to pay, and with which cryptocurrencies?

- Do your customers get exposure to crypto network fees directly? This can make it more expensive for them to pay if a crypto network is very busy.

- Are you clear about dispute resolution? This is particularly important in the absence of traditional refund and chargeback options. Frustrated or unhappy customers are more likely to complain and leave negative reviews.

- How long will customers need to wait on order confirmation? Depending on how you’re allowing customers to pay, they may need to wait longer than usual. Again, this is where using a payments partner can help, as they can often keep both fees and confirmation times very low.

- Do shoppers need education? Customers may appreciate education about how they can pay with crypto, along with guidance on security and avoiding scams.

Confidently help your customers embrace the future of payments

Merchants can choose crypto payment processing options that are simple and familiar. Customers, on the other hand, will have a different payment experience.

There are millions of crypto users who are already ready, willing, and able to pay with crypto. While crypto payment options are becoming easier and simpler, it’s still important for merchants to understand their customers’ experiences and the implications of their decisions in order to make the most of this new growth opportunity.

Ready to get started? View crypto payments extensions.

Learn more about why it’s time to start accepting cryptocurrencies and how to choose a cryptocurrency payments provider.