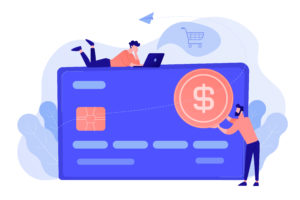

In a cashless society, financial transactions are processed electronically, a trend which has accelerated in recent years.

A few years ago, a cashless society was something we would only read about in fantasy books. However, living in a cashless society could become a reality with today’s trends. Digital payments are now an integral part of virtual experiences.

Some countries are already moving to get rid of cash, especially since both the consumers and government bodies are keen on that trend. Sweden is predicted to become the first cashless nation in the world.

The Swedish economy is set to become 100% digital by 2023. According to the European Payments Council, traditional cash transactions accounted for 1% of Sweden’s GDP in 2019. Cash withdrawals have been steadily declining by about 10% per year.

In this post, you’ll learn the differences between cashless payments and ready cash. You’ll also learn the advantages of going cashless and the issues that need to be addressed before a society can give up on cash entirely.

Traditional v/s Digital Payments

Traditional payments are made directly with cash, through a chip and pin card, or via a bank transfer. Cash and the chip and pin is the standard transaction method for most business to consumer companies.

Cash in the form of notes and coins is something that most people trust. However, there are issues. For starters, it’s a pain getting the right change. Then, there are issues with physically storing and moving the money. Banks, for example, charge a fee for taking money in from shops, and thieves obviously might steal your money.

With chip and pin devices and now contactless payments, businesses reduce the risk of theft and the hassle of depositing money in the bank. Companies do take a transaction fee for managing the payment process, though.

The other benefit of the move to digital payments is the ease of tracking everything. Digital payments make accounting a lot easier and also benefit the government as it reduces the opportunity for tax avoidance and accounting fraud.

The Future of the Payments Industry After COVID-19

Any business that wants to achieve success has to be watching marketing trends within its niche. The same goes for financial services. To keep your company ahead of the game, you have to watch how the market changes and make the necessary adjustments.

COVID-19 has changed the trend of cashless payment systems. As commerce moved from physical locations to online stores, the way we pay took the same route. Often contactless commerce was the only possible way to minimize physical contact.

So, the pandemic was undoubtedly a switching point for the adoption of digital payment technologies. Most niche market businesses had to rethink how they operate and allow cashless payments.

The pandemic accelerated this trend, expediting the move from cash payments by over three years. This move was originally projected for 2023, but the global context advanced it to 2020. The Global Payments Report 2021 revealed that cash was used for just over 20% of the global point of sale transaction volume in 2020. That was a 32% reduction from 2019.

The use of cash in 2020 fell all over the world. Apart from Sweden, other countries are proving to be very close to representing cashless societies. Cash payments represent only 5.4% of the point of sale volume in Canada, 4.5% in Norway, and 11.9% in the US.

The Difference Between Contactless Payments and Mobile Payments

Contactless and mobile payment options are possible through digital means and don’t involve physical contact with cash or cards. Although contactless transactions and mobile payment technology have things in common, they also are very different.

Contactless Payment Systems

Contactless payment transactions are finalized electronically through a wireless technology called NFC (Near Field Communication). The best examples of payment methods using NFC are contactless debit and credit cards. You need to get the card near the reader or give a slight tap to establish a connection and start a transaction.

Mobile Payment Technology for Customers

With mobile payments, customers can pay using mobile banking apps and mobile wallets. Overall, mobile payment technology works similarly to contactless payment systems. Instead of using cards, you use a mobile device, like a smartphone or smartwatch to initiate the transaction.

Most banks have a Mobile App for their clients to make banking transactions. In this case, all you need is a Wi-Fi connection or broadband wireless internet connection to handle the transaction.

Using a Mobile Wallet System, customers use an app or an e-wallet where their credit card details are saved. Apple Pay and Android Pay are the two most commonly known forms of digital wallets globally, though local favorites like AliPay in China also lead some markets. The mobile wallet system uses the same NFC technology as the contactless methods. Open the e-wallet and place the device near the reader to initiate the connection.

Mobile Payment Technology for Merchants

Accepting mobile wallets has become an expectation for merchants. If you are a business owner on the go, you need to be able to accept payments anywhere you are. Using mobile terminals means you can be free of a physical POS terminal that needs to be carried with you.

Mobile terminals are payment portals available on a smartphone or connected tablets. To be able to accept a payment, you need to log into a virtual terminal and manually enter credit card details.

With mobile browser payments, customers can use their mobile phones to pay for your products and services. This is essential, considering that so many eCommerce sales are completed via mobile devices. So, when building websites for your business, make sure you provide an eCommerce solution, like a payment gateway or hosted checkout, that is mobile-friendly. To pay, customers need to enter their payment details into the website’s checkout section.

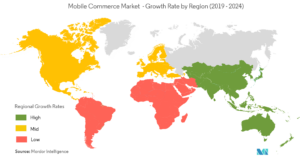

This is critical as M-commerce is thought to be the next big phase in technology involvement.

Source

However, its adoption and level of growth vary depending on the location. The M-commerce market needs increasing adoption of smart devices, better broadband connectivity, cheaper services, and social adoption of services to grow.

It has become more and more popular to browse for favorite products, add to a cart and make online payments via mobile apps. Merchants developed their apps for customers with an eCommerce payment processing solution. The payment processing solution enables businesses to accept card payments within the app. Clients need to register their credit or debit card details into the app before purchasing.

What Are the Pros and Cons of Contactless Payments

An obvious benefit of contactless payments is convenience. All you need is your phone, and you can make cashless payments from everywhere. It requires no physical contact. It’s simple and quick. Here are some other pros of going contactless.

No Cash for Thieves to Steal

Anyone carrying cash is an easy target for criminals. If a thief takes cash from you, it becomes very difficult to track and prove that it was yours.

A study by American and German researchers revealed that crime in Missouri dropped by 9.8% once the state replaced cash welfare benefits with Electronic Benefit Transfer (EBT) cards.

So, theoretically, pickpocketing should dry up in a cashless society.

Automatic Paper Trails

Money laundering, illegal gambling, or drug operations, typically involve cash so that there is no record of the transaction. Illegal transactions are harder if the source of funds is easy to identify. It’s difficult to hide income and avoid taxes when there’s a payment history available at any time.

Cash Management Costs Money

Many businesses need to store the cash, withdraw more if they run out, and deposit the money when they have too much on hand. Some businesses have to hire companies to transport cash safely.

Let’s not forget that banks hire professionals to secure branches against bank robberies.

The need to spend time and money on printing bills and minting coins and then handling and protecting money could disappear in a cashless future.

International Payments Become Much Easier

Traveling abroad requires exchanging money to the local currency. Going into a country that accepts cashless payments makes traveling easier. You can make payments through your card or mobile device.

People can purchase from companies abroad and just wait for the shipment to arrive. You can make purchases from anywhere in the world, provided that the seller will be willing to ship it for you.

The Future of the Payments Industry

There are some reasons why cash is still important but by the looks of it, it will become more of a niche option. According to PwC, several macrotrends will affect the future of payments in the years to come. These are:

- Inclusion and trust: The trend is to focus on digital wallets and mobile money to enable consumer accessibility

- Digital currencies: Central banks are now exploring the use of this type of currency, with 14% performing their own pilot tests.

- Digital wallets: The use of mobile payments will continue to increase, with an estimated compound annual growth rate between 2019 and 2024 of 23%.

- Battle of the rails: Due to increased competition in the financial services industry, card companies and processors are repositioning themselves on the market. Digital wallet providers will continue to seek more interoperability as a result of the fierce competition.

- Cross-border payments: An increase in cross-border payments is expected, which is further reinforced by the adoption of ISO 20022. ISO 20022 aims to ensure a standardized electronic data exchange between financial institutions.

The assumption based on these macrotrends is that we are moving towards a cashless society. This is also evident in the rise of industries that primarily rely on cashless transactions. The subscription economy, for instance, has been growing with the digitalization of economies. According to UBS Wealth Management and Bernstein, so far, the digital subscription economy is a $650-billion market and is set to reach a market size of $1.5 trillion by 2025. That’s an impressive annual growth rate of 18%.

With the increasing relevance of digital payments in the years to come, businesses should find ways to adapt if they want to stay in the game.

At the same time, they will need to implement cybersecurity measures to ensure the protection of consumers using these digital payment methods. After all, with the increase in financial digitalization is the inevitable increase in financial crimes. To prevent fraud, money laundering, and other crimes, greater collaboration among businesses, payment providers, traditional banks, and even governing bodies is ultimately required.

Wrapping Up

Providing the option to buy or sell online has become so common that it makes people wonder if cash is still needed at all. From restaurants to grocery stores and any business, cashless payments are accepted in most places. We were forced to put cash back into our pockets during the pandemic.

The thing is, the trends do still point to cash being mostly obsolete, perhaps even in our lifetime. We’re moving towards a cashless society, where online payments and digital currencies will be the norm and no longer just options. That would mean an increasingly financially interconnected world that can open up vast opportunities for both businesses and consumers. In a cashless society, the world will literally be everyone’s (financial) playground.

About Author

Matt Diggity is a search engine optimization expert and the founder and CEO of Diggity Marketing, The Search Initiative, Authority Builders, and LeadSpring LLC. He is also the host of the Chiang Mai SEO Conference.